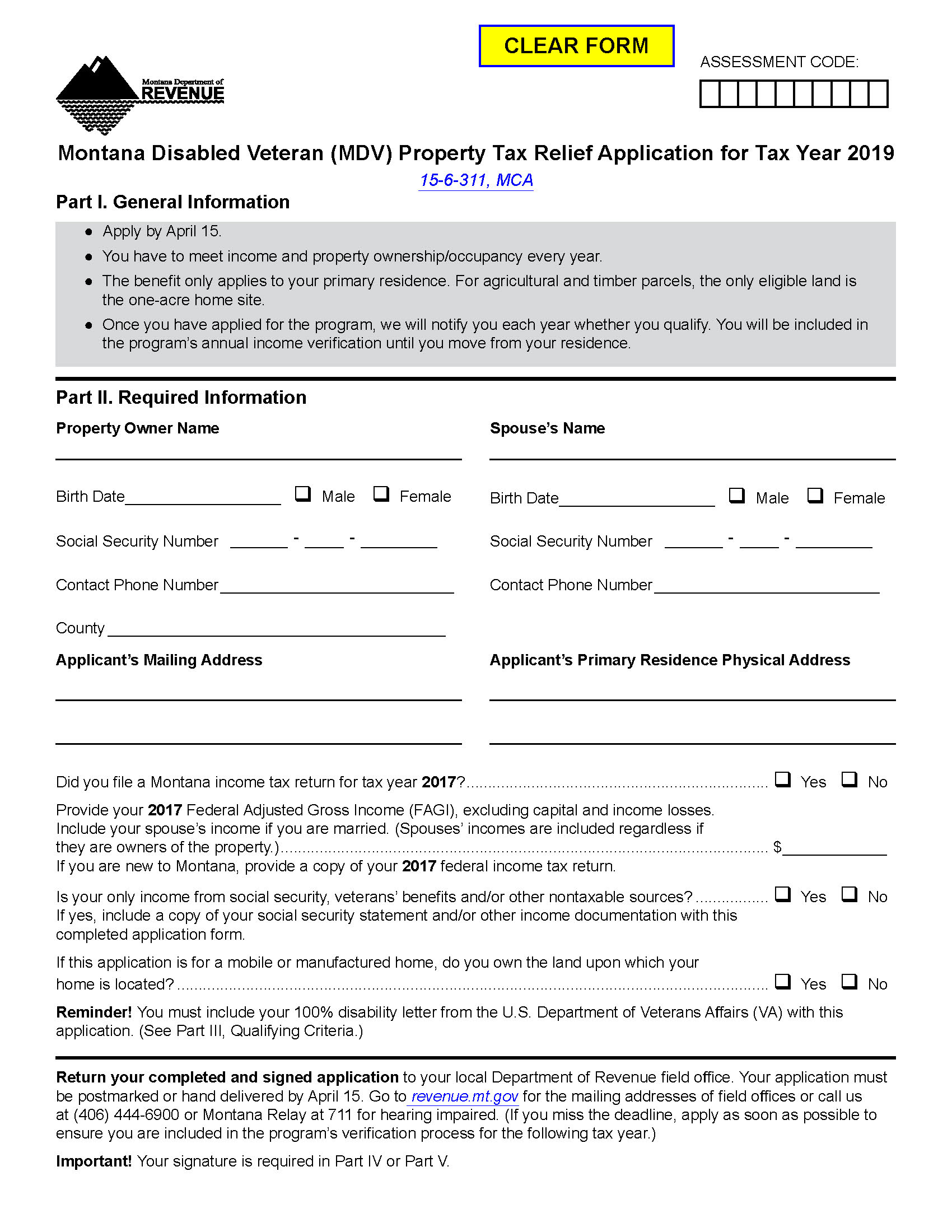

Montana veterans have through April 15 to apply for the Montana Disabled Veteran Assistance Program, which can provide relief on property taxes.

Veterans with 100 percent service-related disabilities and their unmarried surviving spouses may be eligible.

Single veterans may qualify if their federal adjusted gross income is less than $52,507. That limit is $60,585 for veterans who are married or head of household, and $45,775 for unmarried surviving spouses.

Depending on income, the program can reduce general property taxes by 50 to 100 percent on a primary residence.

As long as the applicant owns and lives in his or her home, that application will remain active and the department will send a letter each year with the homeowner’s current status in the program.

See the Montana Disabled Veteran Property Tax Assistance Program (MDV) for more information.