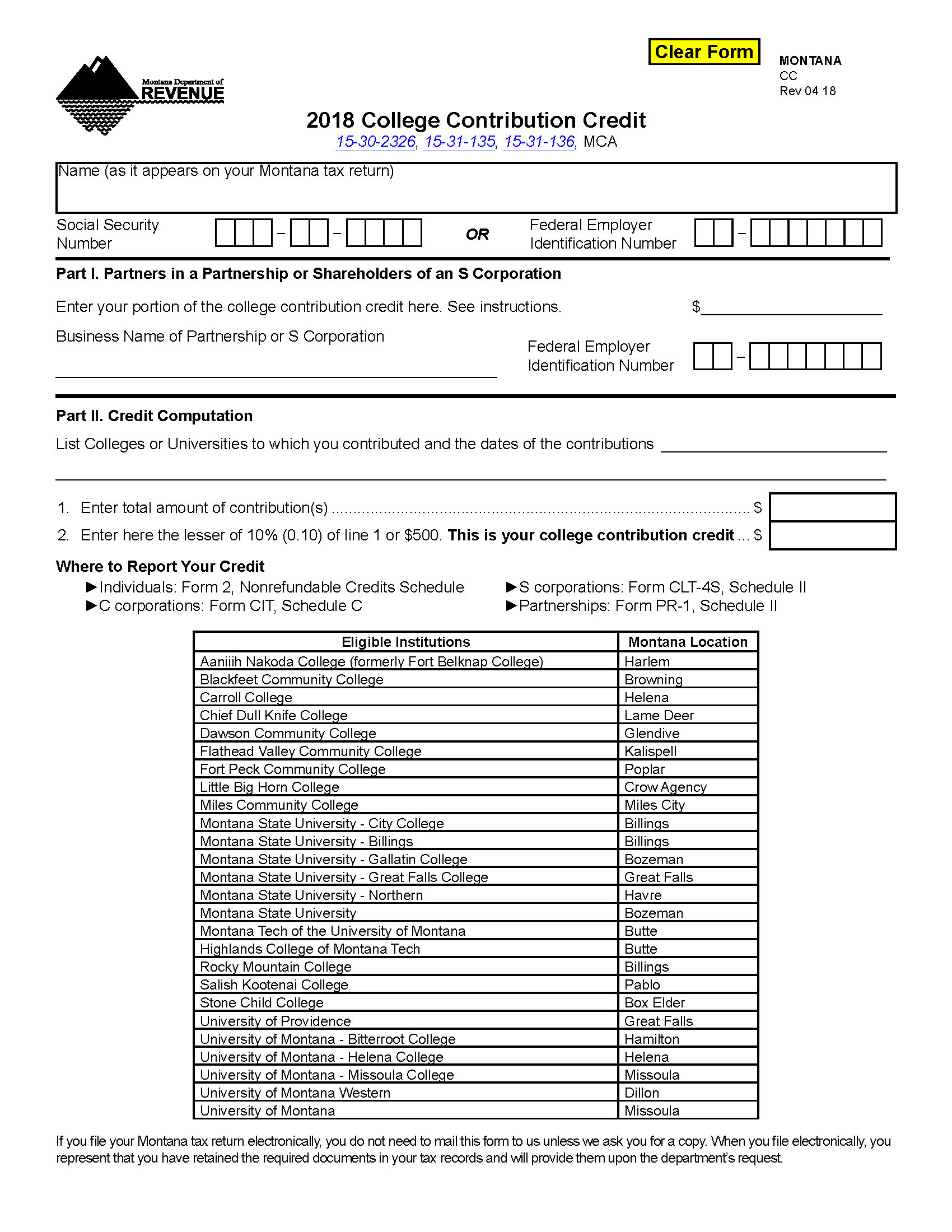

The college contribution credit a taxpayer may claim on the Montana College Contribution Credit (Form CC) is calculated based on the amount of charitable contribution made by the taxpayer to the foundation or general endowment fund of a college or university located in Montana.

Under the Tax Cut and Jobs Act, charitable deductions are not allowed for payments made to institutions of higher education when the taxpayer receives in return the right to purchase tickets for athletic events at the institution either directly or indirectly.

Other deductible charitable contributions made to a college located in Montana still qualify for the credit. However, if you take the credit for Montana tax purposes, you must reduce your charitable contribution by the corresponding amount.