General Cannabis FAQ

Is it legal to buy or sell marijuana in Montana?

As of January 1, 2022, medical and adult use marijuana is legal to purchase in the state of Montana by individuals 21 and over.

Is adult-use marijuana possession and use legal in Montana?

As of January 1, 2021, adults 21 and over may possess and use up to one ounce of marijuana with no criminal penalties.

However, marijuana consumption and possession (including medical marijuana) remains prohibited in public and certain other locations. It is also prohibited under federal law on all federal lands and waters.

Marijuana (except medical marijuana) is prohibited in hospitals and other health care facilities.

Operating a motor vehicle under the influence of marijuana remains illegal.

Contact your local law enforcement agency for more information.

When did adult-use marijuana sales begin in Montana?

As of January 1, 2022, previously licensed medical marijuana license holders are now allowed to sell to adult-use consumers.

Previously licensed means license holders in “green” counties who were licensed on or before April 27, 2021, or who had a pending application on or before April 27, 2021.

Is it legal for individuals in Montana to grow their own marijuana?

Adults may cultivate up to two mature marijuana plants and two seedlings for private use in a private residence, subject to certain restrictions. (Medical marijuana cardholders may cultivate up to four mature plants and four seedlings). The plants may not be visible to the public.

Is growing hemp permitted in Montana?

Yes. Hemp growers are licensed by the Montana Department of Agriculture.

Cannabis Sales and Licensing FAQ

Is adult-use marijuana available for sale in all Montana counties?

No. In “green” counties, where the majority of voters supported Initiative 190 in November 2020, adult-use sales began in January 2022.

In “red” counties, where the majority of voters opposed Initiative 190, adult-use marijuana sales are prohibited.

What types of adult-use marijuana licenses are available?

In addition to continuing the Montana Medical Marijuana Program, the Department of Revenue issues separate licenses for marijuana cultivators, manufacturers, dispensaries, transporters, and testing laboratories.

The Department offers 13 different cultivation or “canopy” licenses for cultivation facilities of different sizes.

A worker permit is required for any employee participating in any part of a marijuana business.

Can anyone apply for a license to grow or sell recreational marijuana, or manufacture recreational marijuana products?

No. From January 1, 2022, until July 1, 2025, only Montana medical marijuana licensees who were licensed on April 27, 2021 (or had an application pending with DPHHS on that date) may be issued a license for cultivation, manufacture, or sale of adult-use marijuana.

Will there be limits on the THC content in adult-use marijuana products?

Yes.

When licensees are able to operate, edible adult-use marijuana products may contain up to 10 mg of THC per serving, and up to 100 mg of THC in an entire package.

The total psychoactive THC of marijuana flower may not exceed 35%.

Topical products may contain no more than 6% THC and no more than 800 mg of THC per package.

For a marijuana product sold as an edible or a food product (including beverages), no more than 100 milligrams of THC. A single serving of an edible marijuana product may not exceed 10 milligrams of THC.

A marijuana product sold as a capsule, transdermal patch or suppository, may not contain more than 100 mg of THC, and no more than 800 mg of THC in an entire package.

These limits do not apply to sales by licensed medical marijuana providers to medical marijuana cardholders.

For any other marijuana, including concentrates and extracts, no more than 800 milligrams of THC per package.

Are medical marijuana and adult-use marijuana available at the same business?

Yes. A licensed medical marijuana dispensary licensed on or before November 3, 2020, may sell adult-use marijuana in the same location as medical marijuana.

Are there adult-use marijuana licenses available for tribes?

Yes. The Department of Revenue may issue a total of eight Combined-Used Licenses – one to each of the federally recognized Native American tribes located in Montana, or to a business entity that is majority-owned by a federally recognized tribe located in Montana. Combined Use Licenses consist one of tier one canopy license and one dispensary license that must be located at the same licensed premise.

Combined Use licensees must operate in a “green county” and within 150 air miles of the exterior boundaries of the reservation, or, for the Little Shell Chippewa tribe, within 150 air miles of the tribal services area. For more information on Combined Use Licenses, see 16-12-225, MCA and ARM 42.39.415.

How can I get more information on licensing for adult-use marijuana cultivation, sales, transportation, manufacture, or laboratory testing?

The Department of Revenue is currently evaluating what rules and processes are necessary about these topics.

Subscribe to the department’s newsletter to receive updates.

Will marijuana licensees be permitted to sell their licenses the way alcohol licensees may sell their licenses to buyers approved by the Department?

No. The marijuana licenses may not be transferred.

Will a cannabis provider need an Alternative Nicotine or Vapor Products License?

You must have an Alternative Nicotine or Vapor Products Retail license if you sell alternative nicotine or related products, including:

- E-cigarettes

- Vapor Devices or Mods

- Accessories

- Liquid or e-juice

The license has a $20 annual fee. You may apply for a new license or renew an existing license using the eStop Business Licenses Service.

You need an alternative nicotine license even if you have a tobacco retailer license.

Who do I contact for additional information about applying for or managing an Alternative Nicotine or Vapor Products Retail License?

If you have questions or concerns about any Tobacco Product License or Alternative Nicotine or Vapor Product License, please call (406) 444-4351 or email DORMiscTax@mt.gov

Local and County Cannabis Regulation FAQ

Which Montana counties approved Initiative 190? Which did not?

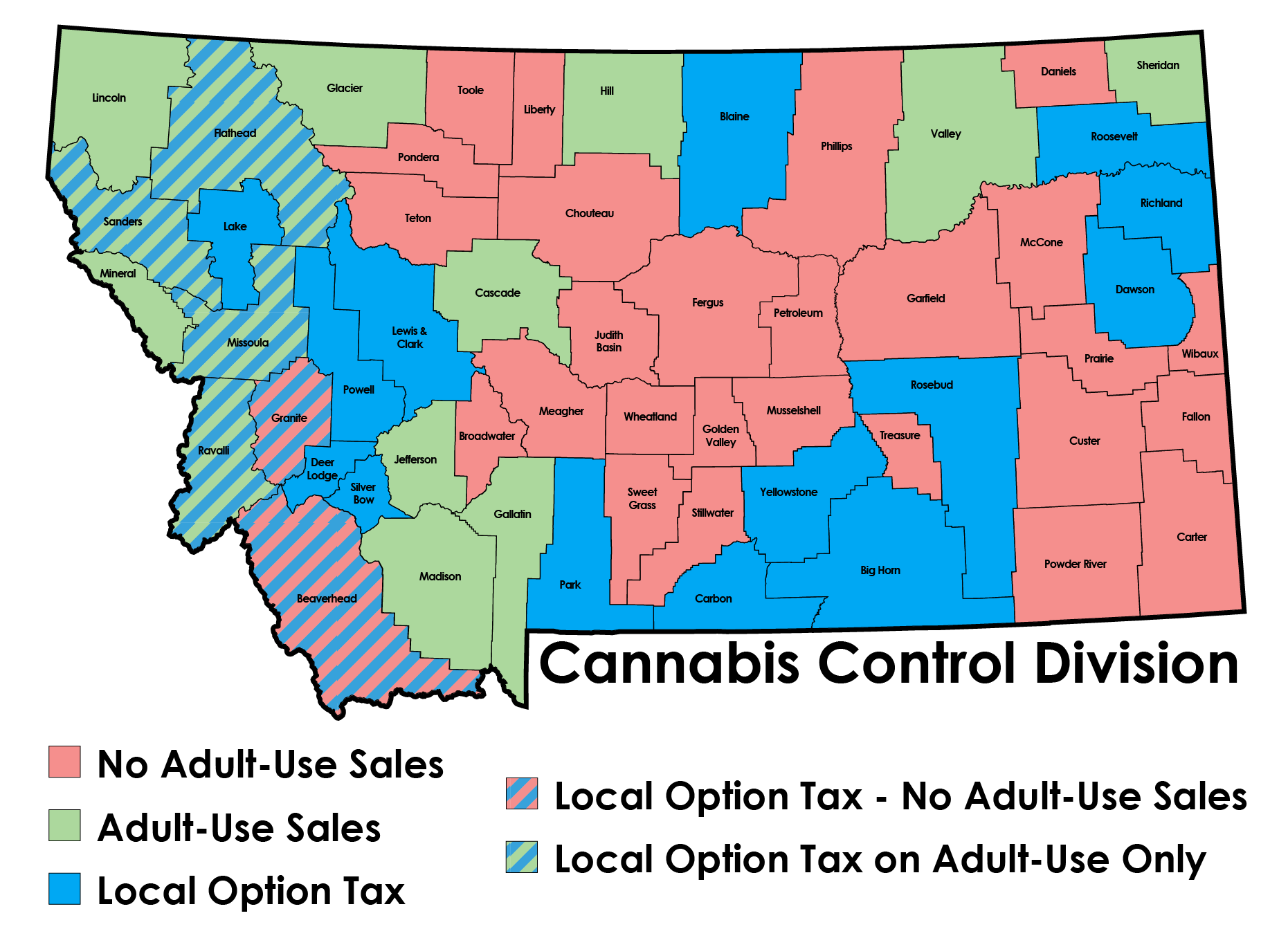

Please refer to the attached Montana map. The map reflects the current status of each county, as determined by the results of Initiative 190 or other local election held after HB-701 was signed into law by the Montana legislature.

- “Red” counties: Adult-use cannabis sales are prohibited.

- “Green” counties: Adult-use cannabis sales are permitted.

- “Blue” counties: County voters opted to include a local option sales sale on cannabis sales.

For more information, please see Cannabis Tax.

Could a county change its position on marijuana businesses operating in its locality?

Yes. In a county where the majority of voters opposed Initiative 190, adult-use sales will be allowed if that county holds an election and a majority of the voters choose to allow marijuana businesses to operate in that jurisdiction.

In a county where the majority of voters supported Initiative 190, certain marijuana businesses could be prohibited if that county holds a local election and a majority of the voters choose to prohibit that type of business from operating.

When can a county expect their local option marijuana excise tax distribution?

Local option marijuana excise tax distributions will be made 60 days after the quarter ending due date to ensure tax moneys have been fully received and reconciled.

| Period | Distribution Date | Collection Period |

|---|---|---|

| First Quarter | June 15 | February 1—April 30 |

| Second Quarter | September 15 | May 1—July 31 |

| Third Quarter | December 15 | August 1—October 31 |

| Fourth Quarter | March 15 | November 1—January 31 |

Cannabis Tax FAQ

Frequently Asked Questions regarding Cannabis Taxation are available on the Cannabis Tax page.

Cannabis Wage Withholding FAQ

As a cannabis provider, how do I register for a wage withholding account?

You can register your wage withholding account electronically through TransAction Portal (TAP) or by using the Montana Department of Revenue Business Registration (Form GenReg).

As a cannabis provider, do I need an Employer Identification Number (EIN) to issue W-2s?

Yes, you cannot issue W-2s to an employee using your Social Security Number (SSN). If you do not currently have an EIN, you can easily apply for one here.

As a cannabis provider, can I compensate my employee(s) with room and board or any other type of non-cash payments?

As defined in 39-51-201, Montana Code Annotated, “Wages means all remuneration payable for personal services, including the cash value of all remuneration payable in any medium other than cash. The reasonable cash value of remuneration payable in any medium other than cash must be estimated and determined pursuant to rules prescribed by the department.” So, if you pay with livestock, living quarters, material goods or other non-cash payments, you must report their market value as wages on a form W-2.

As a cannabis provider, will I be considered and agricultural grower/employer?

No, cannabis is not recognized as an agricultural crop in Montana.

As a cannabis provider, can I give my employees a 1099 NEC (Nonemployee Compensation) to report wages earned?

No, employee wages and withholding must be reported on the federal form W-2.

As a cannabis provider, when can I report compensation earned on a 1099 NEC?

Compensation reported on a 1099 NEC should only be given to those individuals or entities that are established and engaged in a business of their own. UI law defines an independent contractor as “an individual working under an independent contractor exemption certificate provided for in 39-71-417, MCA”. If you have paid or contemplate paying someone as an independent contractor, the individual should have an independent contractor exemption certificate. You should ask for a copy of that and retain it for your records.