Starting with Tax Year 2019, we will not accept the Montana Disregarded Entity Information Return (Form DER-1) or payments for the following entities:

- Single-Member LLCs (SMLLC) owned by partnerships or S corporations

- SMLLCs owned by C corporations, and

- Qualified subchapter S corporation subsidiaries.

The new filing requirements for these entities are explained below.

New Filing and Payment Requirements

Disregarded Entities Owned by Partnerships or S corporations

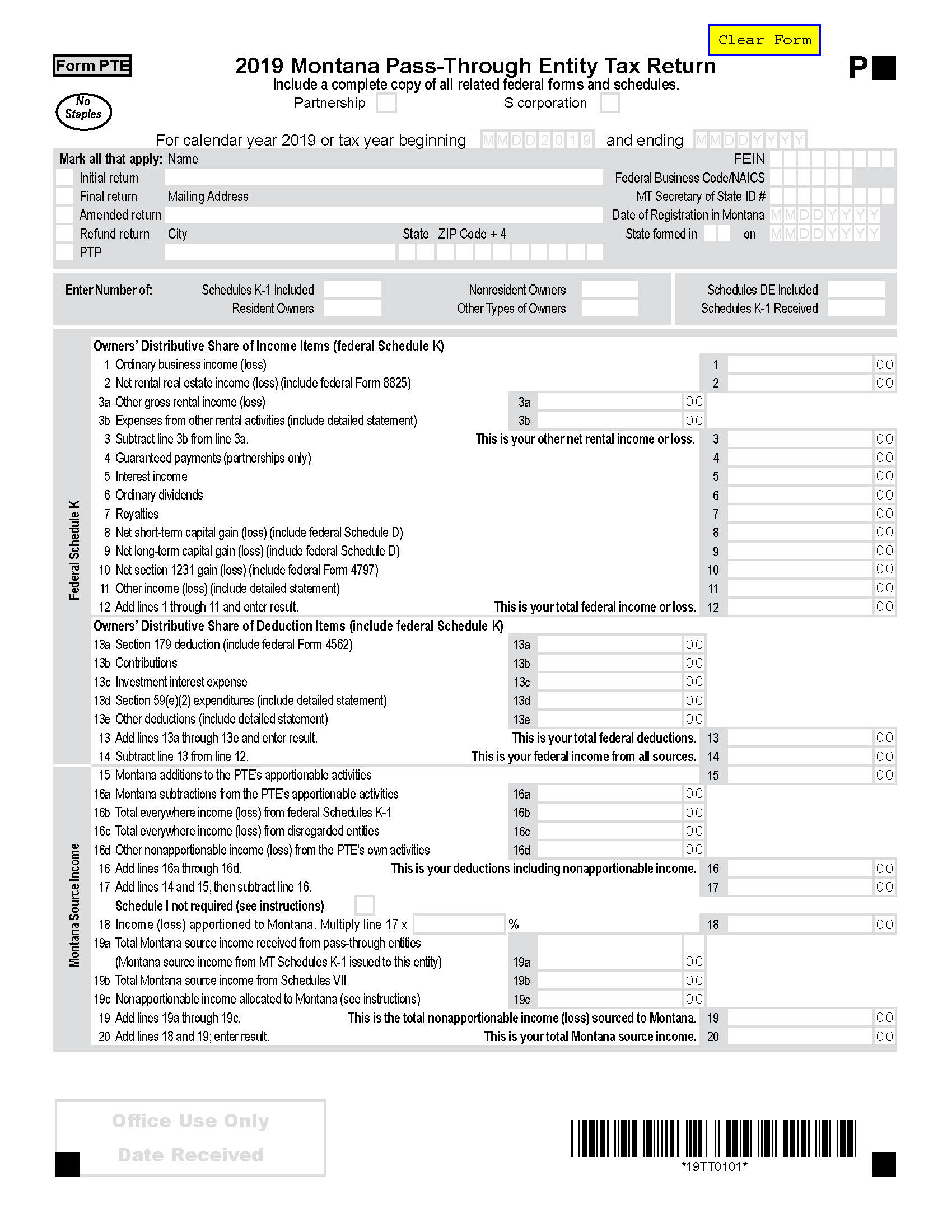

Single-member LLCs (SMLLCs) owned by Partnerships or S corporations must report their Montana source income on their owner’s Montana Pass-Through Entity Tax Return (Form PTE), Schedule VII and Schedule DE. They will no longer file the Montana Disregarded Entity Information Return (Form DER-1).

For the purpose of determining the owner of a SMLLC, disregarded entities owned through a series of SMLLCs are considered directly owned by the first owner that is not a disregarded entity.

Qualified subchapter S corporation subsidiaries must be included on their owner’s Form PTE, Schedule VII and Schedule DE. They will no longer file Form DER-1.

Disregarded Entities Owned by C corporations

Disregarded entities owned by C corporations must be reported on their owner’s Form CIT, Schedule M.

They will no longer file Form DER-1.

Disregarded Entities Owned by Nonresident Individuals, Estates or Trusts

Disregarded entities owned by nonresident individuals, estates or trusts are still required to file Form DER-1. Disregarded entities with existing accounts on the department’s TransAction Portal (TAP) can file the form electronically.

Disregarded entities without TAP accounts can contact us at (406) 444-6900 for help with registering an account.