There are two types of taxes placed on marijuana: state and local. Both occur only at the retail level on end-user purchases. State taxes are set by the Montana Legislature while local-option taxes are optionally enacted by counties.

State taxes are set at 4% for medical marijuana and 20% for adult-use sales.

Local-option tax rates are set by the county up to a maximum of 3% on medical, adult-use, or both. These taxes are in addition to the state taxes.

Businesses can pay their taxes through the Transaction Portal (TAP).

Locality Ballot Initiative Submissions

A locality is required to notify the department of the adoption of a local-option marijuana excise tax at least 90 days prior to its effective date.

The department requires the locality to submit a copy of the ballot initiative placed before the electorate.

The ballot language must include:

- the applicable tax rate,

- the marijuana products subject to the tax, and

- the effective date for the tax.

The ballot initiative copy may be transmitted to the department through the United States Postal Service Mail or any other generally accepted delivery service to:

Department of RevenueATTN: Miscellaneous Tax Unit

125 N. Roberts

Helena, MT 59601

Tax Reporting and Payment

- Beginning January 1, 2022

- For quarters beginning January 1, 2022 and forward, all cannabis tax returns (Medical, Adult Use, and Local Option) will file using a new CAN (Cannabis) account that will be automatically set up for them in our TransAction Portal (TAP).

Local Option Tax

Marijuana Regulation and Taxation (MCA Title 16, Chapter 12) also allows for counties to implement a local option marijuana excise tax not to exceed 3%.

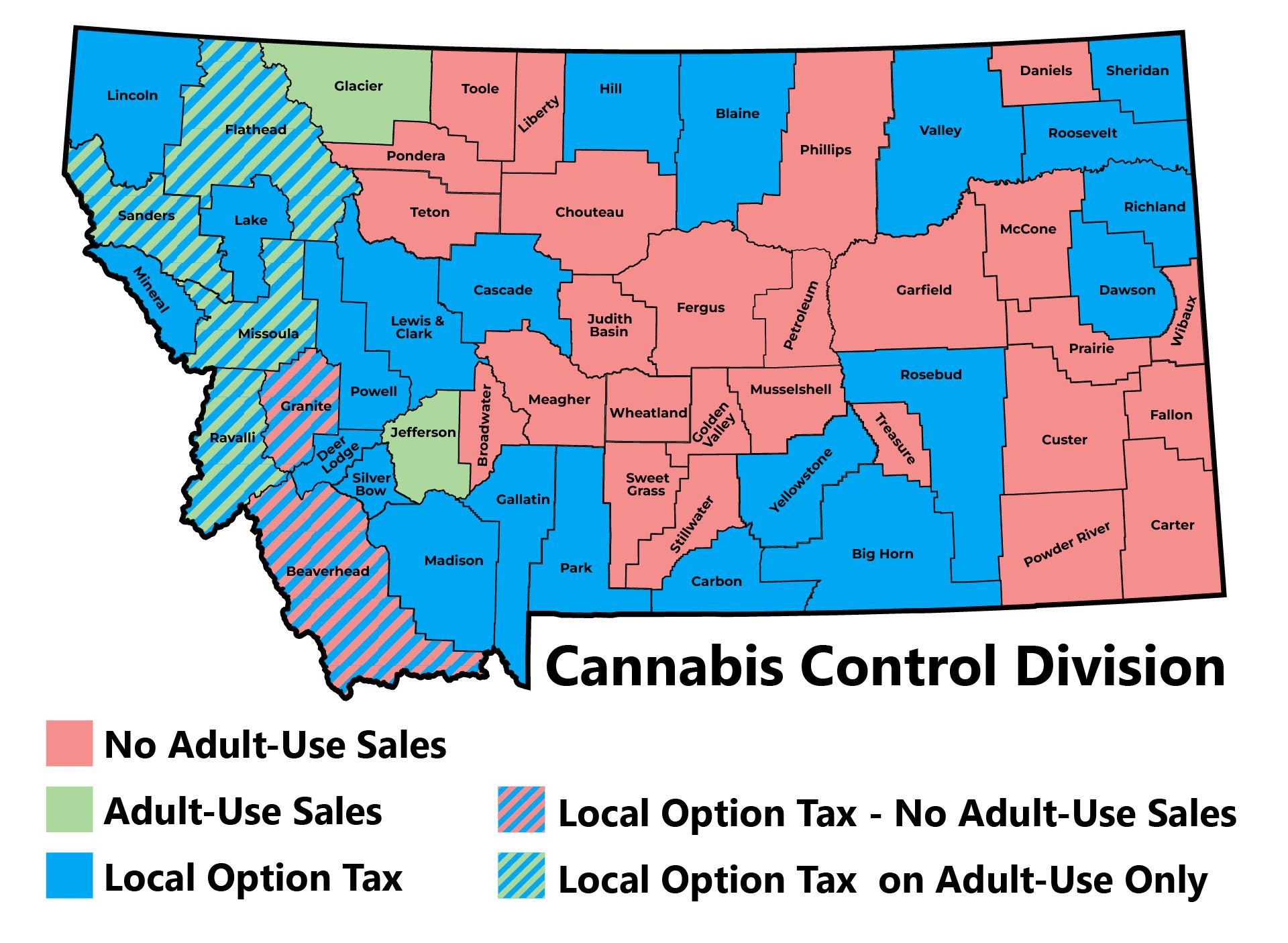

The map in this section indicates the counties which supported I-190, which counties did not, and which counties are implementing a local option tax:

- Counties where the majority of voters supported I-190, allowing adult-use sales, are reflected in green

- Counties where the majority of voters were not in support of I-190, disallowing adult-use sales, are reflected in red

- Counties currently implementing the local option taxes are reflected in blue

The Local Options Marijuana Excise tax is a tax on the retail value of all marijuana and marijuana products sold at an adult-use dispensary or medical marijuana dispensary within a county. The rate of the Local Options Tax must be established by the election petition or resolution. The rate may not exceed 3%.

Information about distributions of local-option marijuana excise taxes can be found in the section Local Option Tax Distribution.

| Cannabis Local Option Tax | ||||

|---|---|---|---|---|

| County | Type | Result | Rate | Effective Date |

| Beaverhead County | Adult-Use | |||

| Medical | Yes | 3% | 3/1/2023 | |

| Big Horn County | Adult-Use | Yes | 3% | 10/29/2022 |

| Medical | Yes | 3% | 10/29/2022 | |

| Cascade County | Adult-Use | Yes | 3% | 2/6/2023 |

| Medical | Yes | 3% | 2/6/2023 | |

| Blaine County | Adult-Use | Yes | 3% | 9/1/2022 |

| Medical | Yes | 3% | 9/1/2022 | |

| Carbon County | Adult-Use | Yes | 3% | 9/5/2022 |

| Medical | Yes | 3% | 9/5/2022 | |

| Dawson County | Adult Use | Yes | 3% | 4/2/2022 |

| Medical | Yes | 3% | 4/2/2022 | |

| Deer Lodge County | Adult-Use | Yes | 3% | 9/5/2022 |

| Medical | Yes | 3% | 9/5/2022 | |

| Flathead County | Adult-Use | Yes | 3% | 3/1/2023 |

| Medical | No | N/A | N/A | |

| Gallatin County | Adult-Use | Yes | 3% | 3/1/2023 |

| Medical | Yes | 3% | 3/1/2023 | |

| Granite County | Adult-Use | |||

| Medical | Yes | 3% | 2/20/2023 | |

| Hill County | Adult-Use | Yes | 3% | 2/6/2023 |

| Medical | Yes | 3% | 2/6/2023 | |

| Lake County | Adult-Use | Yes | 3% | 9/5/2022 |

| Medical | Yes | 3% | 9/5/2022 | |

| Lewis & Clark County | Adult-Use | Yes | 3% | 10/1/2022 |

| Medical | Yes | 3% | 10/1/2022 | |

| Lincoln County | Adult-Use | Yes | 3% | 2/5/2024 |

| Medical | Yes | 3% | 2/5/2024 | |

| Madison County | Adult-Use | Yes | 3% | 2/7/2023 |

| Medical | Yes | 3% | 2/7/2023 | |

| Mineral County | Adult-Use | Yes | 3% | 1/1/2023 |

| Medical | Yes | 3% | 1/1/2023 | |

| Missoula County | Adult-Use | Yes | 3% | 1/31/2022 |

| Medical | No | N/A | N/A | |

| Park County | Adult-Use | Yes | 3% | 2/11/2022 |

| Medical | Yes | 3% | 2/11/2022 | |

| Powell County | Adult-Use | Yes | 3% | 10/1/2022 |

| Medical | Yes | 3% | 10/1/2022 | |

| Ravalli County | Adult-Use | Yes | 3% | 10/1/2022 |

| Medical | No | N/A | 10/1/2022 | |

| Richland County | Adult-Use | Yes | 3% | 1/1/2023 |

| Medical | Yes | 3% | 1/1/2023 | |

| Roosevelt County | Adult-Use | Yes | 3% | 1/31/2023 |

| Medical | Yes | 3% | 1/31/2023 | |

| Rosebud County | Adult-Use | Yes | 3% | 9/1/2022 |

| Medical | Yes | 3% | 9/1/2022 | |

| Sanders County | Adult-Use | Yes | 3% | 2/8/2023 |

| Medical | No | N/A | N/A | |

| Sheridan County | Adult-Use | Yes | 3% | 1/31/2023 |

| Medical | Yes | 3% | 1/31/2023 | |

| Silver Bow County | Adult-Use | Yes | 3% | 10/6/2022 |

| Medical | Yes | 3% | 10/6/2022 | |

| Valley County | Adult-Use | Yes | 3% | 2/21/2023 |

| Medical | Yes | 3% | 2/21/2023 | |

| Yellowstone County | Adult-Use | Yes | 3% | 1/31/2022 |

| Medical | Yes | 3% | 1/31/2022 | |

| Adult-use marijuana sales are prohibited in this county. | ||||

The Local Options Marijuana Excise tax is a tax on the retail value of all marijuana and marijuana products sold at an adult use dispensary or medical marijuana dispensary within a county.

The rate of the Local Options Tax must be established by the election petition or resolution. The rate may not exceed 3%.

Distribution of Local Option Marijuana Excise tax:

- 50% of the resulting tax revenue must be retained by the county

- 45% of the resulting tax revenue must be appropriated to the municipalities on the basis of the ratio of the population of the city or town to the total county population

- 5% of the resulting tax revenue must be retained by the department to defray cost associated with administering the Local Option Marijuana Excise tax

Montana charges a 4% tax on medical marijuana and marijuana products sales and 20% tax on adult use marijuana and marijuana products sales.

The tax applies to the gross retail price when a product is:

- Sold

- Exchanged

- Bartered

- Gifted

TransAction Portal (TAP)

Report and pay your Cannabis Tax in our TransAction Portal (TAP).

Check or Money Order

Mail checks and money orders along with your Cannabis Tax Payment Voucher to:

Montana Department of Revenue

PO Box 6169

Helena, MT 59604-6309

Cash Payments

We only accept cash payments at our drop box in Helena:

Montana Department of Revenue

340 N. Last Chance Gulch

Helena, MT 59601

Monday through Friday, 8:00 AM to 4:00 PM

Cash Payment Instructions

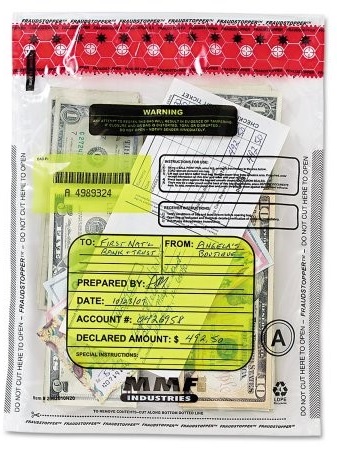

All cash payments must be in a tamper-evident deposit bag no larger than 11″ x 13″.

Multiple bags may be used if needed. Bags may be purchased online at numerous locations and office supply stores.

- Print a Cannabis Tax Payment Voucher

- Include a copy of the voucher in each deposit bag

- Write your name and Provider ID on each deposit bag

To maintain the accuracy of your deposit, please sort cash by denomination and face all bills in the same direction. We will not accept any mutilated or contaminated currency.

Exact amount is required. The department is not equipped to provide change.

The cannabis tax return is due on the 15th of the next month following the end of the quarter:

| First Quarter | April 15 |

|---|---|

| Second Quarter | July 15 |

| Third Quarter | October 15 |

| Fourth Quarter | January 15 |

The cannabis tax is subject to uniform penalties and interest.

Taxpayers may be subject to penalties and interest for failing to file or pay taxes and fees by the due date.

What is included as a “sale” for the cannabis tax? Do I pay the tax on products I give away?

All gross sales of marijuana and marijuana infused products are taxable.

The tax is on the gross retail price, which is the established price for which a marijuana product is sold to a purchaser before any discount or reduction.

“Sale” or “sell” means any transfer of marijuana products for consideration, exchange, barter, gift, offer for sale, or distribution in any manner or by any means. This includes marijuana and marijuana infused products.

A marijuana business may not provide free marijuana or marijuana products or offer samples of marijuana or marijuana products. Marijuana or a marijuana product may not be given as a prize, premium, or consideration for a lottery, context, game of chance, game of skill, or competition of any kind.

If I am a registered cardholder that cultivates my own product, am I subject to cannabis taxation?

No, the dispensaries are the responsible party for collecting and remitting the tax. Any product cultivated for personal use is not taxable. Being a licensed provider for additional cardholders is a taxable relationship.

Will I be taxed on bad debt sales (sales deemed uncollectible)?

Yes. The cannabis tax is calculated on the licensee’s gross sales.

Can I claim a reduction on my cannabis tax return for using higher value products or superior production techniques?

No, the law does not provide for exemptions or reductions of cannabis tax for cost of goods sold.

What will the tax be on marijuana and marijuana product sales?

Adult-use marijuana will be taxed at 20% of retail sales.

Medical marijuana will continue to be taxed at 4% of retail sales.

Local jurisdictions may add an additional tax of up to 3%.

Am I required to file a cannabis tax return if I have no sales for the quarter?

Yes. You must still submit a tax return through the TransAction Portal (TAP) for a zero-dollar return.

What is taxed if I sell marijuana infused products? Can I separate the ingredients on the receipt and only tax the value of the marijuana included in the product?

The entire gross sale amount for the marijuana-infused end-product is subject to the tax.

Can I reduce the price for aged cannabis products?

Yes, if you change your price and that price is offered to all customers, that is the new established retail price.

The established retail price and any changes to that price should be documented and maintained in your records.

Can I offer a reduced price for bulk purchases of cannabis products?

Yes. If the new price is offered to all customers, it becomes the new established price.

The established retail price and any changes to that price should be documented and maintained in your records.

Can I hold a reduced-price sale?

Yes, you may have a reoccurring or random percentage off sale on your products. This will be the established retail price for the day of the sale. See below for more information concerning reduced prices and discounts offered to select individuals or groups.

The established retail price and any changes to that price should be documented and maintained in your records.

Can products be discounted?

Yes, products can be discounted. There is a difference on what is considered the established retail price for that sale and what is the taxable amount, depending on how the discount is offered.

If the discount is offered to all customers, as opposed to a discount that is offered to only a particular individual or group, the established retail price can change. Discounts offered to only medical cardholders or only adult-use customers are not considered an individual or group. Please read a few examples below:

- Example of a non-taxable discount – Every Friday you offer 20% or a discount on a product that has been on the shelf for a particular amount of time. The discounted price then becomes the new established retail price on which you would pay the tax.

- Example of a non-taxable discount – Discounts offered to medical cardholders only. The discounted price then becomes the new established retail price on which you would pay the tax.

- Example of a taxable discount – Discounts offered to a particular group or individual such as veterans or students. The established retail price is the price before the discount has been applied.

If I offer product on credit, when is the tax reported?

Tax is due on the retail price of the products at the end of the quarter in which the product is received by the consumer.

How do I calculate the tax on discounts to individual cannabis customers?

The tax will be applied on the established retail price for the product. Discounts for a group or individual do not change the established retail price.

Products priced below the established price for a select demographic is considered a reduction price; in this instance, tax must still be applied to the established retail price. Only those discounts that are offered to every purchaser are considered to be tax exempt.

As a Cannabis provider, do I need an Alternative Nicotine or Vapor Products Retail License?

You must have the Alternative Nicotine or Vapor Products Retail license if you sell alternative nicotine products, including:

- E-cigarettes

- Vapor devices or mods

- Accessories

- Liquid or e-juice

This license has a $20 annual fee. You may apply for a new license or renew an existing license using the eStop Business Licenses Service.

You must have an alternative nicotine license even if you have a tobacco retailer license.

If I have questions or need additional information about applying or managing my Alternative Nicotine or Vapor Products Retail license, who do I contact?

If you have questions or concerns about any Tobacco Product License or Alternative Nicotine or Vapor Product License, please call (406) 444-4351 or email DORMiscTax@mt.gov.

What records do I need for tax purposes?

Your records should track all sales of marijuana or marijuana products. All sales should include the date of the sale, as well as the quantity, kind, and retail price for each product sold. Your records should also include a detailed, established retail price list and any discounts offered to customers. These records shall be kept for 5 years.

Tax Distribution

The 20% Adult-Use Cannabis Tax and 4% Medical Marijuana tax are distributed at the state level:

- $6 million to the Healing and Ending Addiction through Recovery and Treatment (HEART) account established in 16-12-122, MCA.

- After the HEART distribution, the remainder goes to:

- 20% to Department of Fish, Wildlife, and Parks to be used solely as funding for wildlife habitat

- 4% to the state park account

- 4% to the trails and recreational facilities account

- 4% to the nongame wildlife account

- 3% or $200,000, whichever is less, to the veterans and surviving spouses state special revenue account

- $150,000 to the board of crime control to fund crisis intervention team training

- for the biennium beginning July 1, 2021, $300,000 to the Department of Justice to administer grant funding to local and state law enforcement agencies for the purpose of purchasing and training drug detection canines and canine handlers, including canines owned by local law enforcement agencies to replace canines who were trained to detect marijuana

- The remainder to the general fund

Local-option marijuana excise taxes are distributed to counties 60 days after the return due date. Counties are then responsible for distributions made to municipalities in that county:

- 50% retained by the county

- 45% apportioned to municipalities on the basis of the ratio of the population of the city or town to the total county population

- 5% retained by Department of Revenue for administration

Local-option tax distributions are calculated using actual tax collected during the collection period. Any tax collected or adjusted, regardless of the tax period it applies to, during the collection period will be included in that distribution.

| Period | Distribution Date | Collection Period |

|---|---|---|

| First Quarter | June 15 | February 1—April 30 |

| Second Quarter | September 15 | May 1—July 31 |

| Third Quarter | December 15 | August 1—October 31 |

| Fourth Quarter | March 15 | November 1—January 31 |

Forms and Resources

For more information on Cannabis Taxation, please contact the department’s miscellaneous tax unit:

- Phone

- (406) 444-6900

- DORBitBTU@mt.gov