If you prepare Montana returns for pass-through entities, be aware that they are subject to certain withholding requirements.

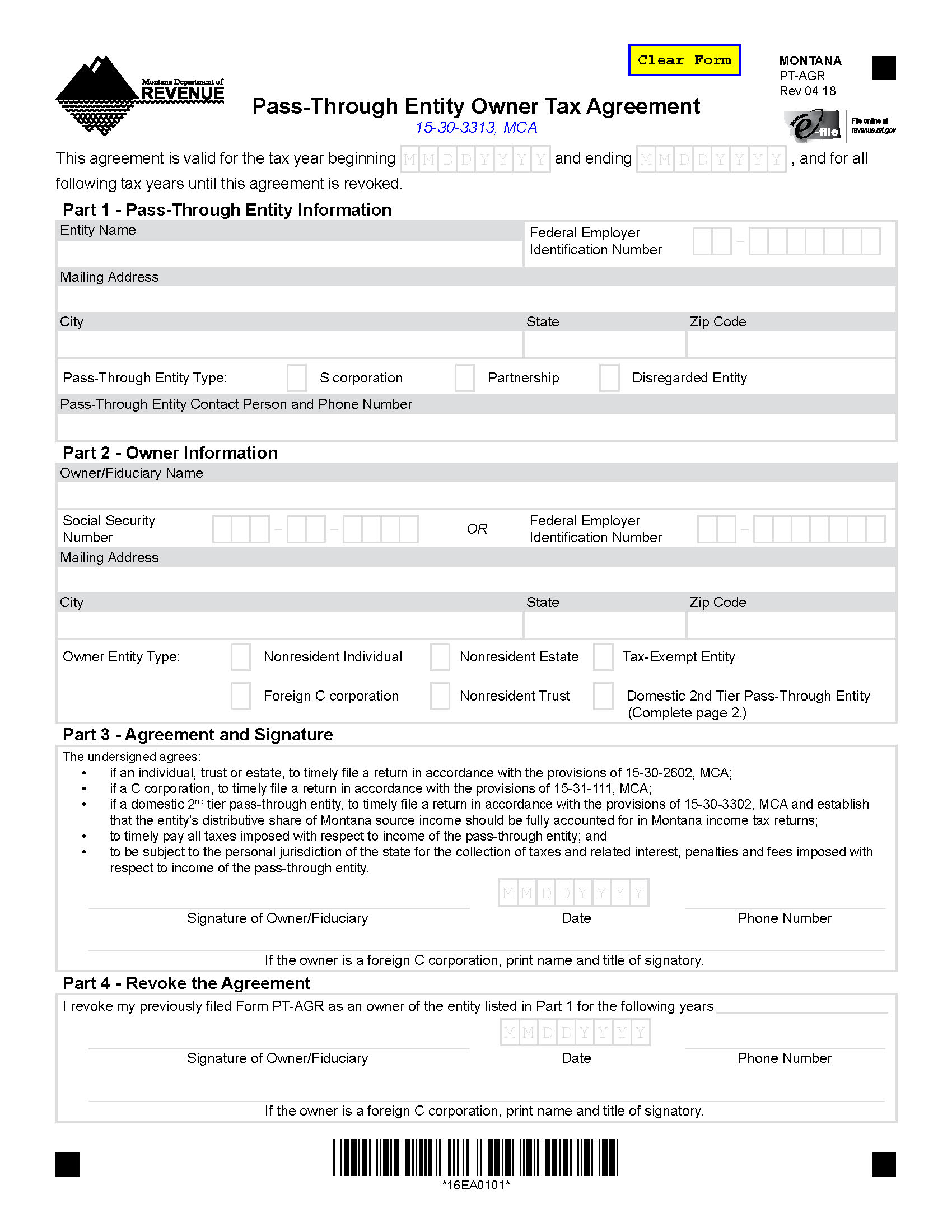

The entity may qualify for a waiver from the withholding requirements for certain owners if the owner files a Pass-Through Entity Owner Tax Agreement (Form PT-AGR).

An owner may file Form PT-AGR if they are a:

- Nonresident individual, estate, or trust;

- Tax-exempt entity administered outside Montana;

- Foreign C corporation; or

- Domestic second-tier pass-through entity

A domestic second-tier pass-through entity is a pass-through entity that is owned by resident taxpayers, including domestic C corporations and other entities whose principal place of business or administration is in Montana.

Forms PT-AGR are filed separately. Do not attach these forms to an income tax return.

You can file Forms PT-AGR on the department’s website through TransAction Portal (TAP) or print a copy from My Revenue.