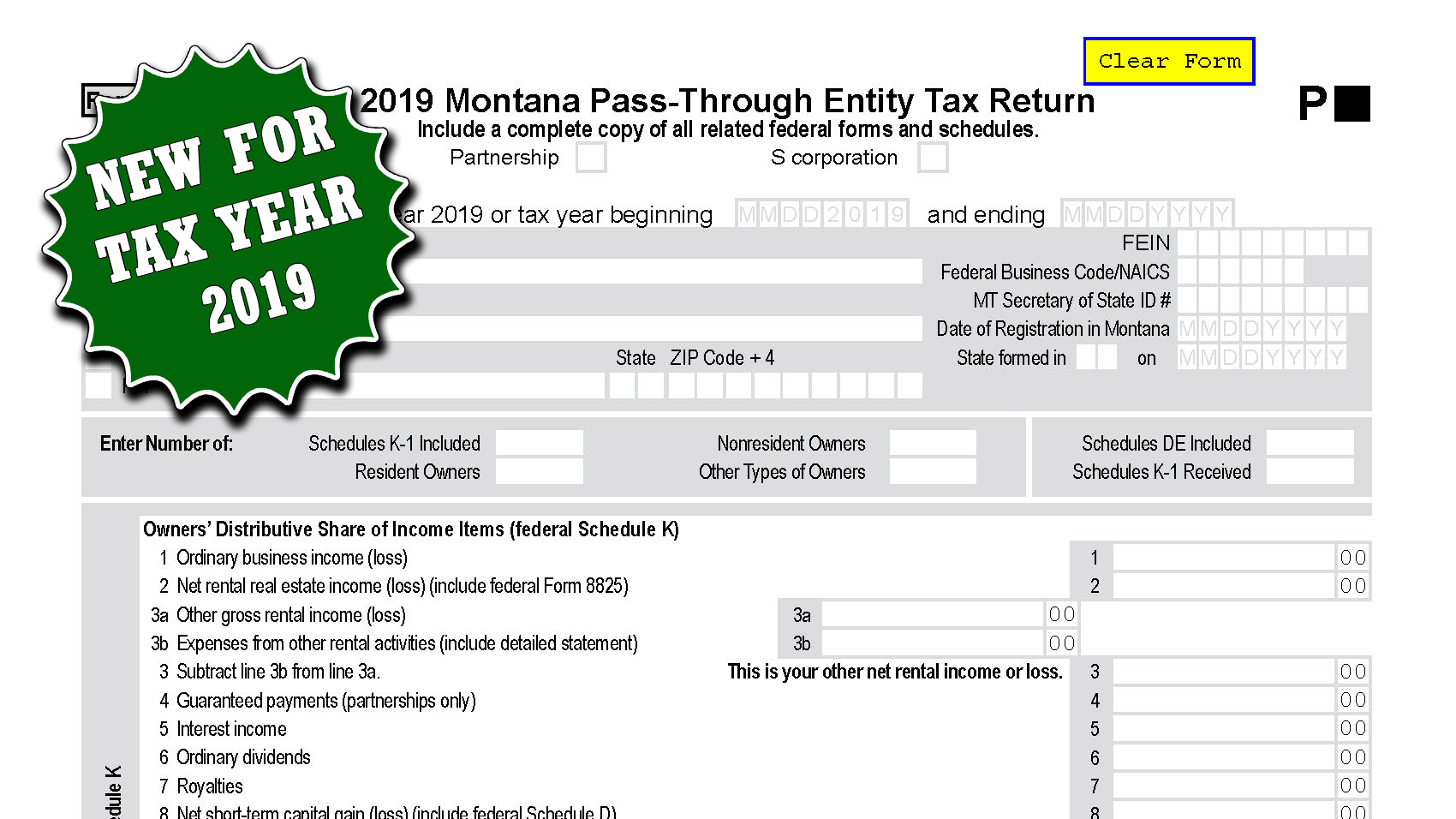

Simplification of Montana Income Taxation

This article was first sent as part of the Tax News You Can Use Newsletter Sign up to get updates delivered directly to your inbox. 2021 Legislative Roundup The 67th Montana ... Simplification of Montana Income Taxation